Finance acumen 101

I was asked a question: "Can you teach me some basic financial acumen?"

I'm glad they put the word "basic" in because that's probably as much as I know. I am by no means a CFO (we have a real CFO now at Clearco who's fantastic). Finance is also such a broad and deep subject that I think in any area where I know a little about, I am only scratching at the surface.

This thread is perhaps useful if you want to know a bit about the many areas around finance, but don't need to become an expert at it.

So this will be a collection of mental models and how I think about finance. I'll keep adding pieces to this collection on Notion as I make posts, please feel free to also poke holes, request topics and areas you'd want more in. I don't know all the answers, but I people who are a lot smarter than me 🙂

Topic #1: cash inflow vs cash outflow

You hear a lot of fancy terms get thrown around a lot in finance: IRR, NPV, NAV, ETC...

You're probably thinking about IRwho? What's that?

At its core, the art of finance is about delta between cash inflow and cash outflow.

When you make $100, how much does it cost for you? $50?

If it costs you $150 to make $100... you should probably stop. Nobody does that knowingly, although there might be many examples out there that makes you think that:

Wait, didn't Uber lose 58 cents per ride?

Don't a lot of neobanks pay $300 to acquire a customer but make 1% on interchange?

Didn't Pets.com fail because the cost of shipping was more than they made per sale?

The truth is that none of these companies truly believe their unit economics is fundamentally negative, it's just a matter of when. Naturally, the time you create value and the time of investment are usually different.

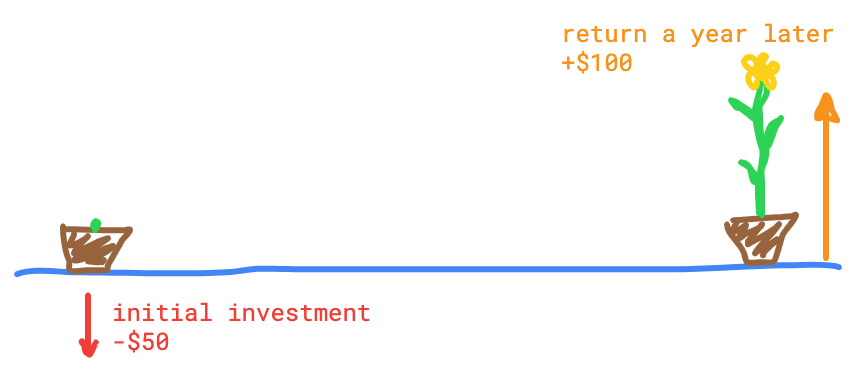

For example, you buy seeds and plant them (your investment), you harvest a year later (your gains).

There are 3 key variables:

cash outflow (your initial investment)

cash inflow (your future returns)

time it takes

Which would you rather: $75 in 6 months or $100 in a year

Time value of money and IRR

In order to answer this question, you need to normalize the points of comparison down to one variable. This is what we call the "rate of return".

Some other terminologies you'll hear:

Interest rate (often denominated as r or n)

Internal rate of return (IRR)

So that 75/50 = 50% return, while 100/50 = 100% return. But the million-dollar question is, is that extra 6 months worth the additional 50% return?

The quick mental model of this is: "If you recycle your capital, would you get net more or net less?"

If you put 75 in the same instrument that returns 50% after 6 months, what would you get? 75 x 1.5 = $112.

This is where the time value of money equation starts to come into play:

FV = PV x [ 1 + (i / n) ] (n x t)

However, the easiest thing you can do is just use the XIRR function on google sheets or excel!

[ Spreadsheet, you can make a copy ]

Hard lessons: you can't eat IRR.

You can eat profits, but you can't eat IRR.

Is a phrase a mentor once told me. IRR could look the best in the world, but it doesn't pay the bills. It only pays for the bills once you realize the profits.

Notice how I said: "if you recycle your capital" above.

What if you can't? If you can't put your money back in for another 6 months and realize that extra 50% return? In those cases, it might better to wait for the full year.

That might be a very real scenario with the plant. If you harvest it at month 6, it doesn't mean that you can grow it again the same way for the remainder of the year.

Real world applications and business models

I'll dive a bit into how the financial models work for each of these in the following weeks:

Equity investments

Working capital loan

Inventory financing

Invoice factoring

Later, we'll get into fancy ones like:

Credit cards

Venture debt

As promised, I'll track these here: